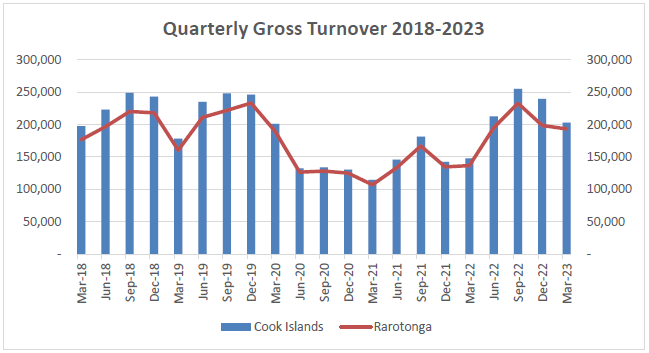

Tax Statistics is a quarterly publication of Value Added Tax (VAT) data. Taxation Statistics series looks at how Value Added Tax (VAT) is collected on Sales of Goods and Services & Income versus the Purchases of Goods & Services here in the Cook Islands.

Taxation Statistics March Quarter 2023

Key facts

Our Reports and Excel tables can be downloaded from the folders below

More information on Taxation Statistics

Explanatory Notes

Scope: VAT is a tax on consumption, so if businesses purchase goods and or supplies services they will be liable to pay tax on the goods or services they will use in their operations at 15.0 per cent.

Data Collection: We receive the data via email for inclusion in the taxation series from the revenue management division of the Ministry of Finance and Economic Management.

Data Processing: The data is received in MS Excel format and transferred to MS Access for processing and data is run through a number of queries to change text fields to number fields e.g. April 2013 is changed to 1304. So this code is used to sum all the column fields that have this code for the month of April 2013 and so on. Other steps include putting the correct industry codes for the business that do not have any industry code associated. When all processes are complete

we extract the data for tabulation in the Taxation series.

Definitions:

Value Added Tax This tax is 15.0 per cent and is payable on taxable activities.

Taxable activities Any activity carried out continuously or regularly, involving the supply of goods or services to any other person for a consideration, but not necessarily for a profit.

Gross Turnover Total money generated on production in the Cook Islands for the period covered.

Industry A particular form of economic/commercial activity e.g. construction.

Revisions This is carried out when there is a change in data (this maybe to account for late payment of obligations) or if improvements to methodology used in preparing the taxation series is implemented, this will be mentioned in the write up of the quarterly affected.

Symbols

(p) Provisional – data used is provisional to populate tables until finalised.

(r) Revisions – these are made when changes occur to the data used or methodology improvements are made.

For further clarification, please do not hesitate to contact the office.