A quarterly consolidated statement of the accounts of the monetary authorities, banks, and other bank-like institutions excluding non-bank financial institutions. Banking Statistics is a measure of banking activities carried out by the four commercial banks operating here in the Cook Islands.

Banking Statistics – September Quarter 2023

Key facts

For the September Quarter 2023:

- Net foreign assets increased to 374.0 million when compared to June quarter (345.1 million) for all banks surveyed.

- Total lending for the September quarter 2023 was recorded at 239.0 million increasing by 2.1 per cent when compared to the June quarter 2023.

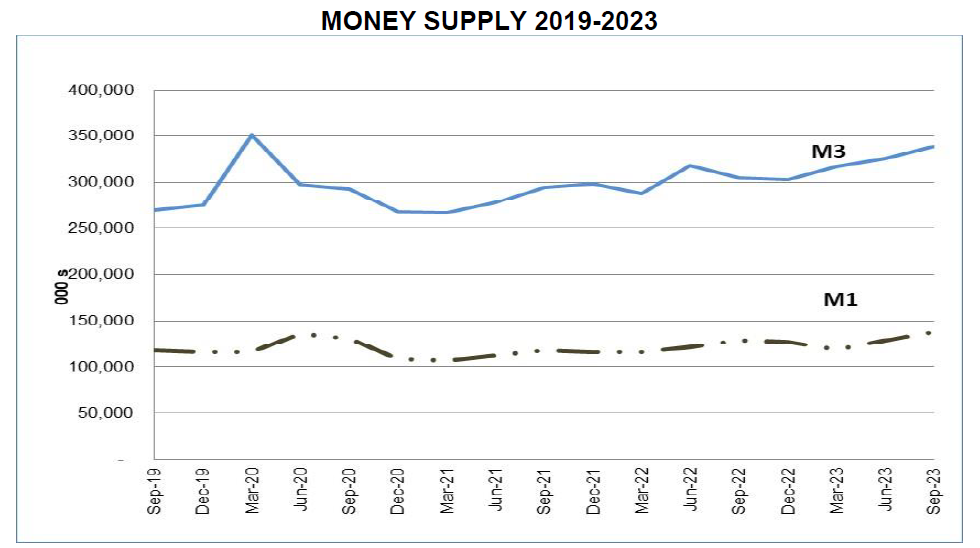

- The money supply increased by 7.5 per cent.

- There were no changes in rates for the September quarter 2023.

More information on Banking Statistics

Aggregates are compiled from the Banking Survey which covers the Four commercial banks in the Cook Islands: ANZ, Bank of the South Pacific (BSP), Bank of the Cook Islands (BCI) and Capital Security Bank (CSB). The Cook Islands does not have a Central Bank and uses the NZ Dollar as its currency.

Narrow Money (M1) consist of Notes and Coins in circulation and Demand Deposits. M2 consist of narrow money (M1) and quasi money (savings, demand and term deposits), Net foreign position of the banks, Net domestic credits.

Transactions are valued in accordance to international standards.

Explanatory Notes

Scope: These Four (4) banks are Australia and New Zealand banking group (ANZ), Bank of the South Pacific (BSP) Bank of the Cook Islands (BCI) and Capital Security Bank (CSB). The survey does not cover offshore banking activities of the other financial institutions operating in the Cook Islands that do not offer

banking facilities that residents can access, like deposit taking and loan facilities, etc.

Data collection: Banking Statistics data was traditionally collected via banking survey forms sent to the commercial banks to fill out and return. At the start of 2013, the data for this series was collected from the Financial Supervisory Commission (FSC) using the prudential report forms. The reasons for the change in data

collection include: the FSC already collects the data from the banks in its role as the monitoring

agency for financial institutions; collecting the data from the FSC reduces respondent burden on the banks; and information derived from the data received from the FSC raises the reliability of the data for users.

Data processing: FSC provides a report via email to our office for processing into the banking statistics series.

Residents:

Individuals and households – Resides or intends to reside in the Cook Islands for one year or longer.

Legal and social entities – Includes government departments and government owned organisations, branches of foreign direct investors, corporations, companies, and nonprofit institutions. A legal or social enterprise

which has a centre of economic interest in the Cook Islands e.g. produces goods and services or owns land and buildings located in the Cook Islands. An international bank, financial institution or trust company which has a physical presence and conducts business in the Cook Islands, whether with residents, non-residents or both, is classified as resident. Cook Islands’ embassies and consulates abroad are also considered to be residents.

Non Residents:

(Includes residents of New Zealand)

Individuals and households – Resident outside the Cook Islands or someone who intend to reside in the Cook Islands for less than one year.

Legal and social entities – Includes foreign governments, foreign banks, international banks, foreign embassies, international organisations corporations or companies with no centre of economic interest in the Cook Islands (but which may have a registered office in the Cook Islands).

Public Enterprises: These are government owned and/or controlled enterprises which obtain their revenue primarily from the sale of goods and services on a commercial basis.

For further clarification, please do not hesitate to contact the office.