Key facts

For the June Quarter 2022:

- Net foreign assets increased to 330.8 million.

- Total lending for the June quarter 2022 sat at $247.9million.

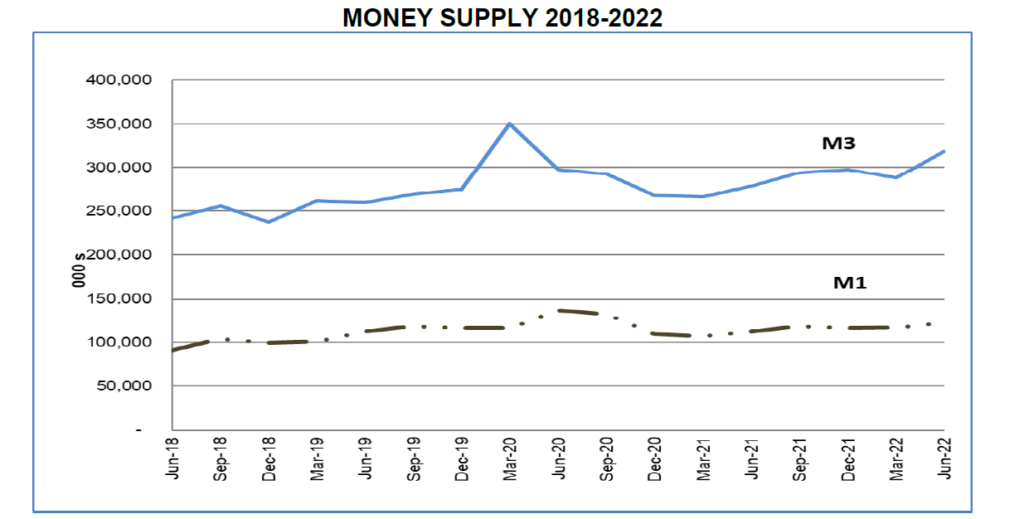

- The money supply increased by 14.8 per cent.

- There were changes in interest rates for two banks surveyed. BSP and BCI both lowered their rates for Term deposits (3 months) from 3.25 to 2.60 and 2.75 to 2.60 respectively. ANZ, BSP and BCI also lowered their rates for owner occupied housing loans to 7.25 per cent

More Information about Banking Statistics

Aggregates are compiled from the Banking Survey which covers the Four commercial banks in the Cook Islands: ANZ, Westpac, Bank of the Cook Islands (BCI) and Capital Security Bank (CSB). The Cook Islands does not have a Central Bank and uses the NZ Dollar as its currency.

Narrow Money (M1) consist of Notes and Coins in circulation and Demand Deposits. M2 consist of narrow money (M1) and quasi money (savings, demand and term deposits), Net foreign position of the banks, Net domestic credits.

Transactions are valued in accordance to international standards.